Buying your dream car with a loan is an exciting prospect, but it’s crucial to approach it with careful consideration. From evaluating your finances to researching different lenders, several factors come into play when applying for a car loan. In this comprehensive guide, we’ll explore ten essential steps to ensure a smooth and successful car loan application process.

Evaluate Your Finances Before Taking a Car Loan

Before diving into car loans, it’s essential to take a good look at your finances. Evaluate your income sources – salaries, bonuses, investments – and break down your monthly expenses into fixed (rent, bills) and variable (dining out, entertainment) categories. Understanding your revenue and expenses will help you make informed decisions about loans.

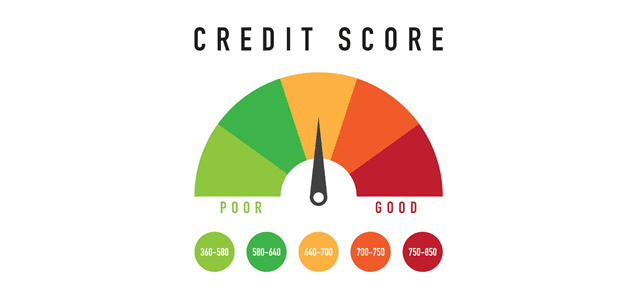

Determine Your Credit Score

Your credit score is a crucial factor that lenders consider when evaluating your creditworthiness. It reflects your ability to repay debt based on your credit history and repayments. In India, credit scores typically range from 300 to 900, with higher scores indicating lower credit risk. Obtain your credit report from reputable credit agencies like Experian, Equifax, or CIBIL to assess your creditworthiness before applying for a car loan.

Research Different Lenders

With your credit score and financial situation in hand, it’s time to shop around for the best auto loan deal. Explore options from banks, non-banking financial institutions (NBFCs), and online lenders. Evaluate interest rates, loan terms, processing fees, early repayment penalties, and customer service reputations. Consider peer-to-peer and online lending platforms for potentially better terms and faster approvals, but thoroughly research their reliability.

Scrutinize Loan Terms and Conditions

Carefully review the terms and conditions of a car loan before committing. This includes the interest rate, loan tenure, Equated Monthly Installment (EMI) amount, processing fees, prepayment penalties, and any additional costs. Ensure you understand these terms and agree with your lender on the prepayment conditions.

Select the Right Car for Your Needs

With numerous options available in the car market, it’s essential to decide on the car style that suits your needs, such as hatchbacks, sedans, or SUVs. Test-drive a few models from your shortlist to make an informed decision. If you’re considering a pre-owned car, conduct thorough inspections and obtain a comprehensive understanding of the vehicle’s history.

Calculate the Total Cost of Ownership

When taking out a car loan, consider not only the monthly EMI but also the total cost of ownership over the loan term. This includes additional costs like insurance premiums, fuel expenses, maintenance and repair charges, and depreciation. Evaluate your annual expenses and calculate the overall cost of ownership, subtracting any potential trade-in or resale value at the end of the loan period.

Choose the Appropriate Loan Type

Understand the different types of car loans available in India, such as fixed-rate loans and floating-rate loans. Fixed-rate loans offer steady monthly EMI payments and protect against interest rate fluctuations, while floating-rate loans may have lower initial rates but are subject to market changes. Some lenders also offer hybrid loans that combine elements of both. Choose the loan type that aligns with your risk tolerance, market outlook, and preference for stability versus flexibility.

Consider a Down Payment

While a car loan can cover the entire purchase price, making a down payment can be advantageous. It reduces the loan amount and monthly interest payments, potentially resulting in a lower interest rate and easier loan repayment over time. Lenders may also view a down payment as a commitment to the loan, increasing your chances of approval and better loan terms.

Scrutinize the Fine Print

Carefully read the fine print of the loan agreement to understand all the terms and conditions, including clauses, loan tenure, EMI payments, prepayment penalties, processing fees, and any hidden fees. Don’t hesitate to consult with a financial advisor or legal expert for guidance.

Prepare for Contingencies

Life can throw unexpected challenges that may impact your ability to repay loans. Build a financial safety net by establishing an emergency fund covering two to five months of living expenses. Consider loan insurance for added financial protection, despite the associated costs, as they provide peace of mind during uncertain times.

By following these ten steps, you can navigate the car loan process with ease and confidence, ensuring you find the best loan option for your needs and budget. Remember to research thoroughly, nitpick every detail, and plan for contingencies to make an informed decision.